- Checkmark payroll android#

- Checkmark payroll software#

- Checkmark payroll professional#

- Checkmark payroll mac#

A completely searchable knowledge base is also available from the CheckMark Payroll website, and users also have access to brief, online tutorials that provide step-by-step assistance with both the data conversion process as well as complete application setup.

Checkmark payroll android#

The time tracking feature also includes a mobile app for both iOS and Android smart phones and tablets.ĬheckMark Payroll users can access help from within the application, with additional help resources available from the CheckMark website including a complete user’s manual, which can be downloaded or accessed online. In addition, there is a time and attendance solution available that tracks employee time online including PTO, with a scheduling option available as well. CheckMark does offer add-on HR services that are designed for small businesses, offering an HR support center, an employee handbook wizard, and access to essential HR documents. One of CheckMark’s biggest drawbacks is the lack of a portal that employees can use to view paystubs and other information.

In addition, CheckMark Payroll offers easy integration with numerous third-party accounting applications including QuickBooks. CheckMark Payroll also integrates with other CheckMark applications such as Multiledger, CheckMark’s accounting application.

Checkmark payroll software#

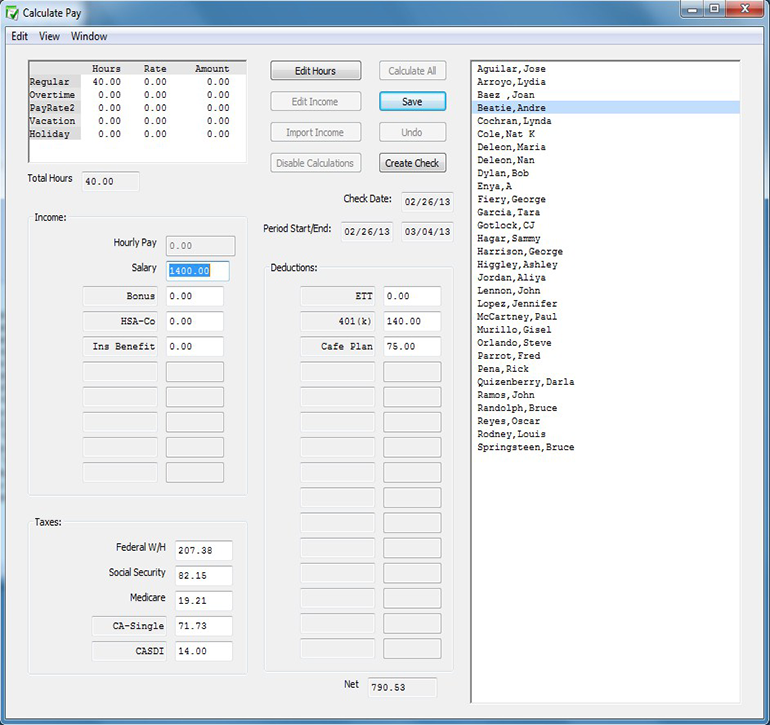

All CheckMark Payroll reports can be viewed on screen, printed, saved as a text file, or exported to Microsoft Excel for customization if desired.ĬheckMark Payroll allows users to import time from numerous timekeeping software applications using Excel or a text file format. The application also supports e-filing of W-2s and W-3s, as well as state filing where allowed.ĬheckMark Payroll offers numerous payroll related reports including employee information reports such as wage and tax information, employee earnings reports which include an earnings register and hours register as well as a check summary, and various tax summary reports. All necessary federal tax forms such as IRS Form 940, 941, 943, W-2, and W-3 can be printed on both pre-printed forms and blank paper. territories, with tables updated frequently throughout the year. In addition, users can track any additional information using one of the several user-defined fields included in the application.Ĭheckmark Payroll offers tax tables for all 50 states and U.S. There is also an additional income option available for companies that pay employees outside of their regular pay such as commissions or tips. The application supports both regular paychecks as well as direct deposits, and users have the option to import hours from timekeeping applications or enter hours manually or by using a grid-style spreadsheet which speeds up the entry process for those entering payroll data for a large number of employees.

In addition, users can track both sick and vacation hours for all employees.

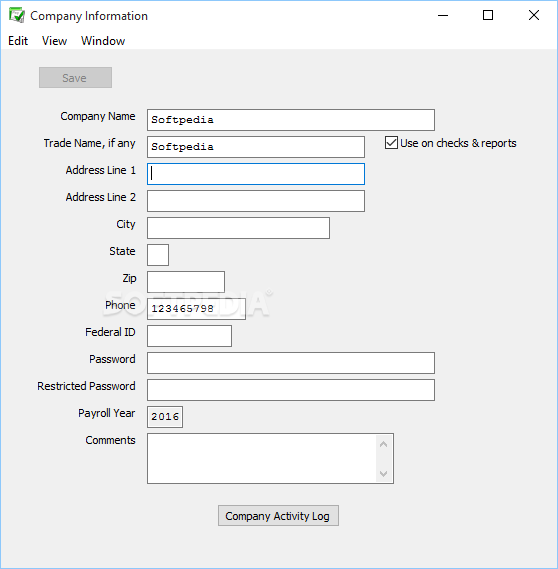

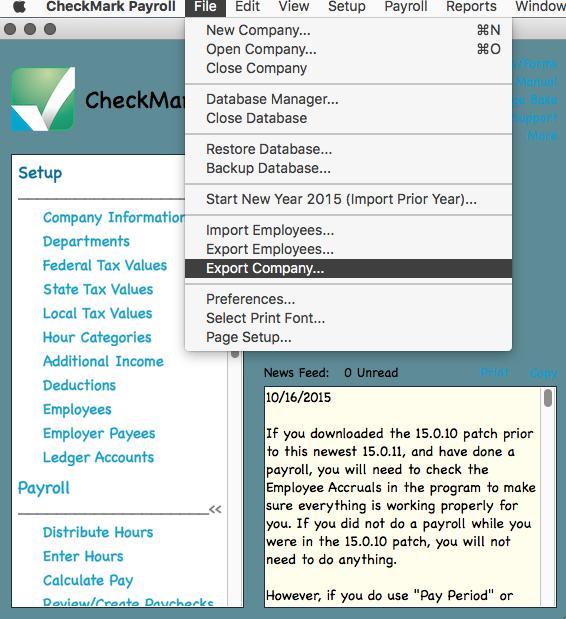

Users can also access system features from the drop-down menu at the top of the screen.Ĭlick for larger image: The CheckMark Payroll main screen is divided into three sections Setup, Payroll, and Reports.ĬheckMark Payroll supports up to 12 different hour categories that can be used for employees that are paid hourly, with pre-defined categories included in the application. The main navigation screen is divided into three sections Setup, Payroll, and Reports, with a variety of options available for each area. Though CheckMark Payroll integrates with other CheckMark applications, it is designed to be used as a stand-alone payroll solution.ĬheckMark Payroll is best suited for small businesses, though it can also be used by accounting firms that offer payroll services to their clients.ĬheckMark payroll supports an unlimited number of employees and companies at no additional cost, with after-the-fact payroll capability included in the application.

Checkmark payroll mac#

CheckMark applications work on both Windows and Mac operating systems and is designed to be deployed on-premise.

Checkmark payroll professional#

From the 2020 reviews of professional payroll systems.ĬheckMark Payroll is part of CheckMark’s suite of accounting and payroll applications currently available to U.S.

0 kommentar(er)

0 kommentar(er)